Did you accidentally send money to the wrong person using UPI? Don’t panic! While UPI transactions are designed for swiftness and convenience, there are still steps you can take to attempt to recover your funds if you’ve made a mistake.

This blog outlines the crucial measures to be undertaken in the event of an erroneous Unified Payments Interface (UPI) transaction in India. Time is of the essence, and prompt action is essential to maximize the possibility of retrieving your money.

What are UPI Transactions?

The UPI system facilitates instant money transfers between bank accounts linked to mobile numbers. It involves four key parties:

- You (The Sender): Initiates the money transfer.

- Receiver: The recipient of the money transfer.

- Your Bank (Sender’s Bank): Holds your bank account linked to the UPI app.

- Receiver’s Bank: Holds the receiver’s bank account linked to their UPI app.

- NPCI (National Payments Corporation of India): Oversees UPI transactions.

Reversal Eligibility:

The success of a UPI transaction reversal hinges on two crucial factors:

- Transaction Status: Only pending or failed transactions are eligible for reversal requests. Once accepted by the receiver, a reversal might be impossible.

- Time Frame: Act swiftly. The quicker you initiate the reversal process, the higher the likelihood of recovering your funds.

Steps for Reversal:

-

Immediate Contact with Receiver: Reach out to the intended recipient and explain the error. If they haven’t accepted the money and are cooperative, they can directly initiate a reversal on their end. This is the fastest and most efficient resolution.

-

Reporting the Error to Your UPI App: Access your UPI app’s transaction history, locate the erroneous transaction, and find the “dispute” or “report” option. Provide all relevant details, including the transaction reference number (UTR) and a clear description of the mistake.

-

Contacting Your Bank: If your UPI app lacks a dispute resolution option, or the issue persists, contact your bank’s customer care immediately. Inform them of the situation and request a UPI transaction reversal. Be prepared to provide the UTR, date, and transaction amount.

Additional Considerations

Important Steps While You Reverse:

-

Gather Proof: Take screenshots of:

- Transaction details in your UPI app

- Communication with receiver (if any)

- Error messages during the transaction Having this evidence is helpful if you need to escalate the issue later.

-

Be Patient: Reversals can take a few business days. Follow up with your bank or UPI app provider for updates.

-

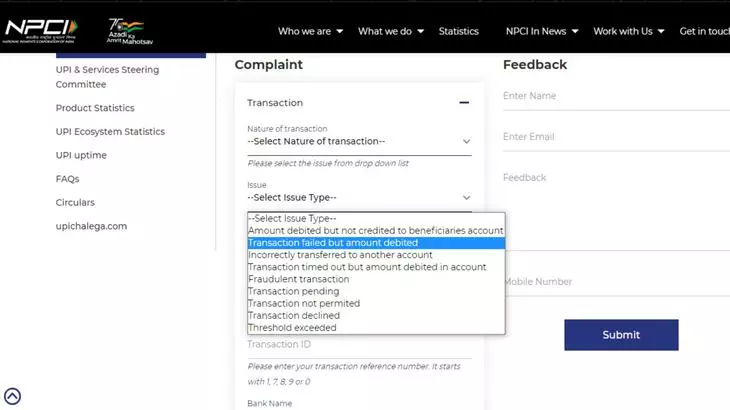

Escalate if Needed: If your bank or UPI app provider isn’t responsive, consider escalating the issue to the NPCI Ombudsman. The NPCI website has a grievance redressal mechanism for such situations.

Suspected Fraudulent Activity:

If you suspect fraud, report it immediately to your bank and the authorities. Additionally:

- Block the UPI ID: Most UPI apps allow blocking suspicious UPI IDs to prevent future transactions.

- Report Cybercrime: If you believe you’ve been a victim of cyber fraud, file a complaint with the National Cyber Crime Reporting Portal (https://cybercrime.gov.in/).

Preventing Errors

Prevent Mistakes: Keep Your UPI Transactions Safe

Here’s how to avoid sending money to the wrong person:

-

Double-Check Every Time: Before confirming, carefully verify the recipient’s UPI ID or mobile number. One typo can mean big trouble!

-

Don’t Send to Strangers: Only send money to people you know and trust. Verify any unfamiliar requests before hitting send.

-

Use Reputable Apps: Stick to well-known and secure UPI apps offered by reputable banks or financial institutions.

-

Turn On Two-Factor Authentication: Add an extra layer of security by enabling two-factor authentication on your UPI app.

Please share your thoughts in the comments. At theproductrecap.com, we are open to friendly suggestions and helpful inputs to keep awareness at peak.